In the vast landscape of financial decisions, borrowing money stands out as a pivotal choice that many Australians face at various stages in their lives. Whether it’s stepping into the property market, funding education, or kickstarting a business venture, loans play a crucial role in shaping our financial trajectories. However, making informed decisions about loans is essential to avoid pitfalls and ensure a secure financial future. In this blog post, we’ll explore the intricacies of borrowing in the Australian context, offering insights and strategies tailored to the unique needs of Australians.

1. Types of Loans

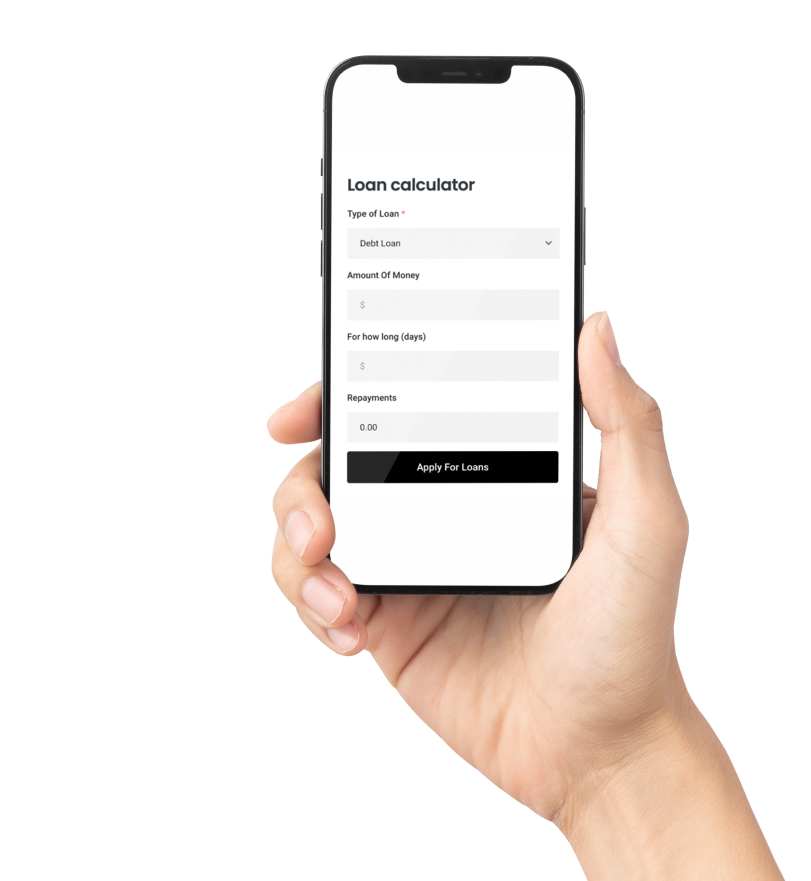

Australia offers a diverse array of loans, each designed to cater to specific needs. Home loans, personal loans, car loans, and student loans are among the options available. Understanding the features and benefits of each type empowers borrowers to make choices aligned with their financial goals.

2. Comparing Interest Rates and Fees:

The key to smart borrowing lies in deciphering the fine print. Comparing interest rates and fees across different lenders is crucial. By comprehending the true cost of borrowing, including fees and charges, borrowers can make well-informed decisions. Negotiating with lenders and seeking the best deals can save significant amounts over the loan term.

3. Responsible Borrowing Practices:

Responsible borrowing begins with a clear understanding of one’s financial capacity. Creating a budget, assessing affordability, and maintaining a good credit score are fundamental steps. A healthy credit history opens doors to better borrowing opportunities and ensures a smoother borrowing experience.

4. Financial Strategies for Loan Repayment:

Effective loan repayment strategies are essential for managing debt responsibly. Making extra payments, exploring refinancing options, and considering debt consolidation are valuable techniques. These strategies not only accelerate debt repayment but also contribute to financial freedom and peace of mind.

5. Planning for Long-term Financial Goals:

Borrowing should align with broader financial objectives. Whether it’s homeownership, education, or retirement planning, loans can be strategic tools to achieve these goals. Integrating borrowing decisions into long-term financial planning ensures that loans become stepping stones, not stumbling blocks, on the path to financial success.

6. Understanding Government Support and Incentives:

Australians can leverage government support programs and incentives related to loans. First home buyer grants, education loans, and small business funding initiatives are available. Understanding the eligibility criteria and application processes enables individuals and businesses to benefit from these valuable resources.

In conclusion, smart borrowing is not just about obtaining a loan; it’s about making choices that enhance financial well-being. By understanding the nuances of loan options, comparing terms diligently, practicing responsible borrowing, implementing effective repayment strategies, aligning borrowing with long-term goals, and exploring available government support, Australians can navigate the loan landscape with confidence and financial wisdom. Making informed borrowing decisions today can pave the way for a secure and prosperous tomorrow.